Optimizing Your College Cost Savings: Key Financial Preparation Techniques

As the expense of college remains to climb, it ends up being progressively essential to develop reliable monetary preparation methods to maximize your university cost savings. The path to college can be an intimidating one, loaded with many economic obstacles along the road. With cautious planning and factor to consider, you can pave the means for a brighter future without jeopardizing your financial security. In this conversation, we will certainly check out key economic planning strategies that can assist you navigate the intricacies of college cost savings and ensure you are well-prepared for the trip ahead. Whether you are a moms and dad saving for your youngster's education or a trainee looking to fund your very own university experience, twist up and obtain ready to begin on an economic journey that will form your future.

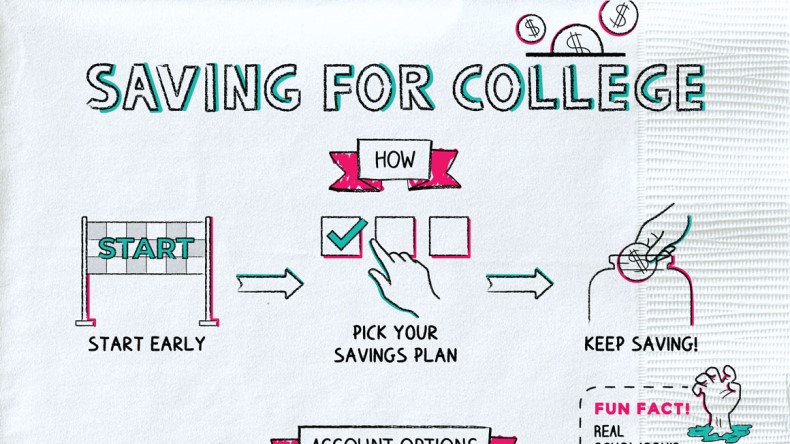

Start Conserving Early

To take full advantage of the potential growth of your university financial savings, it is important to begin saving early in your monetary planning journey. Starting very early enables you to benefit from the power of compounding, which can considerably boost your financial savings over time. By starting early, you give your money even more time to profit and grow from the returns created by your financial investments.

When you begin saving for college early, you can additionally make the most of different tax-advantaged financial savings vehicles, such as 529 plans or Coverdell Education and learning Financial Savings Accounts. These accounts use tax benefits that can assist you conserve better for college costs. In addition, beginning very early gives you the opportunity to add smaller sized amounts over a longer duration, making it more workable and much less burdensome on your budget.

An additional advantage of beginning very early is that it allows you to set reasonable savings objectives. By having a longer time horizon, you can better intend and change your savings technique to satisfy your university funding requirements. This can aid ease tension and provide peace of mind understanding that you are on track to achieve your financial savings goals.

Check Out Tax-Advantaged Savings Options

529 plans are prominent tax-advantaged cost savings options that supply a series of financial investment choices and tax obligation advantages. Payments to a 529 plan expand tax-free, and withdrawals for certified education and learning expenses are likewise tax-free. Coverdell ESAs, on the other hand, allow contributions of as much as $2,000 per year per beneficiary and deal tax-free development and withdrawals for qualified education expenses.

Set Realistic Conserving Objectives

Producing reasonable conserving objectives is a necessary step in effective financial planning for college costs. When it pertains to saving for college, it is crucial to have a clear understanding of the costs involved and set attainable objectives. By establishing reasonable conserving goals, you can guarantee that you are on track to meet your financial requirements and stay clear of unneeded stress and anxiety.

To start, it is essential to estimate just how much you will certainly need to save for university. Consider elements such as tuition fees, textbooks, lodging, and other various expenditures. Looking into the typical costs of universities and universities can offer you with a baseline for setting your saving goals.

When you have a clear concept of the amount you require to save, simplify right into smaller sized, manageable objectives. Set annual or month-to-month targets that straighten with your current monetary scenario and earnings. This will certainly assist you stay determined and track your progression over time.

In addition, take into consideration using tools such as university cost savings calculators or functioning with a financial expert to acquire a deeper understanding of your conserving possibility (Save for College). They can supply valuable insights and advice on just how to optimize your cost savings strategy

Consider Different Investment Methods

When planning for college cost savings, it is crucial to discover different investment techniques to make best use of the development of your funds. Buying the ideal methods can aid you attain your financial savings objectives and offer financial safety and security for your child's education and learning.

One typical investment strategy is to open up a 529 university savings my company plan. This plan provides tax benefits and enables you to buy a selection of financial investment choices such as supplies, bonds, and shared funds. The earnings in a 529 strategy grow tax-free, and withdrawals used for certified education expenditures are likewise tax-free.

Another approach to think about is investing in a Coverdell Education And Learning Interest-bearing Account (ESA) Like a 529 strategy, the earnings in a Coverdell ESA expand tax-free, and withdrawals are tax-free when used for certified education expenditures. The contribution restriction for a Coverdell ESA is reduced compared to a 529 strategy.

Capitalize On Scholarships and Grants

To even more enhance your college savings technique, it is important to maximize the chances provided by scholarships and grants. Scholarships and grants are financial assistances given by numerous establishments and companies to assist trainees cover their college expenses. Unlike gives, scholarships and finances do not need to be paid back, making them an excellent alternative to minimize the monetary burden of college.

Scholarships are normally awarded based on quality, such as academic achievements, sports capabilities, or artistic skills. They can be provided by universities, exclusive companies, or federal government entities. It is necessary to research and use for scholarships that line up with your toughness and rate of interests. Numerous scholarships have details eligibility standards, so be certain to inspect the needs and deadlines.

Grants, on the other hand, are usually need-based and are supplied to pupils that demonstrate monetary demand. These grants can come from government or state governments, colleges, or exclusive organizations. To be thought about for gives, pupils commonly require to complete the Free Application for Federal Trainee Help (FAFSA) to establish their eligibility.

Taking benefit of grants and scholarships can considerably minimize the quantity of cash you require to save for college. It is important to start using and looking into for these financial aids well ahead of time to boost your opportunities of receiving them. By thoroughly considering your alternatives and putting in the effort to seek out scholarships and grants, you can make a considerable effect on your university financial savings approach.

Conclusion

In conclusion, optimizing university financial savings calls for very early planning and exploring tax-advantaged savings options. Setting realistic saving objectives and taking into consideration various financial investment methods can likewise add to a successful savings plan. In addition, making use of scholarships and gives can even more reduce the financial burden of university expenditures. By carrying out these essential financial planning approaches, people can guarantee they are well-prepared for their college education.

As the price of college proceeds to increase, it becomes significantly crucial to create reliable economic preparation methods to maximize your college savings. In this conversation, we will discover vital economic preparation strategies that can aid you browse the complexities of college cost savings and ensure you are well-prepared for the trip ahead.When you begin conserving for university early, you can also take advantage of Read Full Report various tax-advantaged cost savings lorries, such as 529 strategies or Coverdell Education and learning Financial Savings Accounts.As you consider the importance of beginning early in your university cost savings trip, it is crucial to check out the numerous tax-advantaged financial savings choices readily available to optimize your cost click over here now savings possibility.In conclusion, optimizing college savings needs early planning and exploring tax-advantaged financial savings options.